PAR Grant Program

PAR Program Annual Timeline

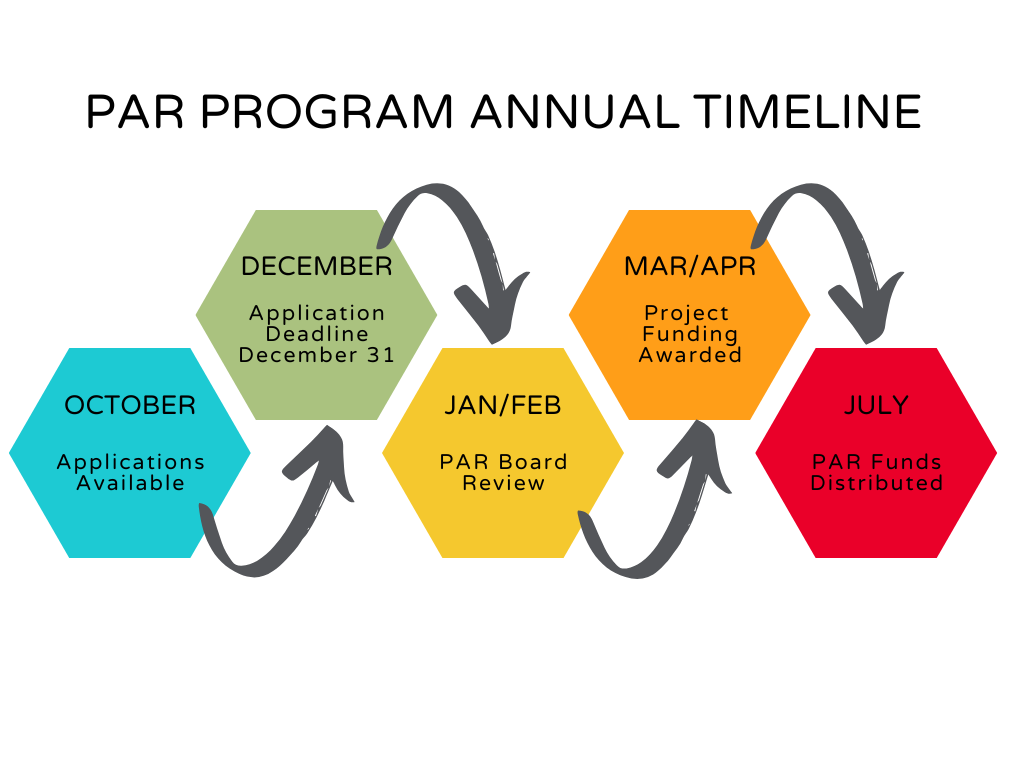

- All requests for PAR tax funds must be submitted via application provided by the PAR Program. Applications are available each year starting October 1. The PAR Program may revise the attached application prior to making it available each year.

- All applications must be submitted prior to the application deadline. Late applications will not be considered. Applications will be received each year, October 1-December 31.

- The PAR Board will review every application, accompanying material, and shall identify and recommend which grants the City Council should approve via majority vote.

- Applicants may be required to make a presentation and discuss the merits of their proposals in front of the PAR Board or City Council.

- The PAR Program will provide notice to applicants regarding the PAR Board recommendations to the City Council and the City Councils final decisions on distribution of funds to be received. Those applicants who were disqualified or denied funding will also be notified.

PAR Grant Application

If you are interested in applying for a PAR funds, please fill out the PAR Program Application Form. Before applying, please review the Policy and Procedures of PAR Tax Funding. If you have any questions, please contact the PAR Board at parboard@springville.org.

PAR Program Policy

PAR Program Application

PAR Program Overview

What is the PAR Program?

The PAR program is a resident-approved sales tax initiative in Springville City to boost the quality of life for residents through Parks, Arts, and Recreation (PAR).

PAR Tax Purpose

The PAR tax provides additional funding for the community. One tenth of one percent of the City’s sales tax goes to fund community improvements such as, but not limited to City owned cultural or recreational facilities, private nonprofit cultural organizations, a qualifying facility within the geographic area of an entity that is a party to interlocal agreement with the City, and ongoing operating expenses of a City owned recreational facility.

Eligibility

In order to qualify for PAR tax funds, an organization must:

- Be a 501(c)(3) nonprofit organization, or a city funded recreation, arts, or cultural program or facility.

- Qualifying 501(c)(3) nonprofit organization must:

- Have, or commit to have, a significant presence and manage/present, in Springville City; and

- Have as a primary purpose the advancement and/or preservation of natural history, art, music, theater, dance, or cultural arts.

Program Duration

On November 2, 2021, a majority of Springville City voters approved the Parks, Arts, and Recreation Tax. The PAR tax went into effect on April 1, 2022 and will last for 10 years. The November 2031 General Election will include a ballot proposition to continue the PAR Tax for the next ten years.

What Projects can be Funded?

PAR Tax funds can be use for a variety of projects and programs, in accordance with Utah State Code 59-12-1402 and Springville City Code 5A-2-101. Funding may be used to support municipal or nonprofit 501(c)(3) organizations providing programs such as, but not limited to:

| 501(c)(3) Nonprofit Organizations | City Capital Improvements |

|---|---|

| Theater Groups | Parks |

| Art Festivals | Recreation Facilities |

| Bands | Trails/Bike Paths |

| Museums | Golf Course Amenities |

| Symphonies | Playing Fields/Courts |

PAR Funding Ideas

Is there a specific project or program that you think should receive funding? Submit your ideas and suggestions here. Suggestions will be reviewed by the PAR Board in January.

PAR Application Process Guide

PAR Tax Advisory Board (PAR Board)

The PAR Board was created by the City Council to review applications for PAR funding. The board consists of 17 volunteer citizens of Springville City who give opinion on funding requests.

Award Recipient Requirements

After the City Council approves the final annual PAR funding distribution list through the budget process, each organization receiving a grant shall:

- Enter into an agreement with the City prior to receiving funds and provide all required dates, documentation, and information listed in the Policy and Procedures of PAR Tax Funding.

- The required agreement must be executed by the organization receiving a grant within 60 days of the City Council approving the PAR funds.

- PAR Program funds will be disbursed in accordance with the City’s fiscal year (July 1- June 30). Distribution of funds will be at the discretion of the City. Organizations who do not expend all their grant funds shall return any unused portion of the grant to the City by June 30th of the fiscal year, unless otherwise determined by the City.

- Each organization that receives PAR Program funding shall ensure that all promotional items, programs, publications, performances and other printed materials include the PAR Program logo or other language required by the PAR Program supplied by the City.

- Provide required itemized expended funds reporting for audit in a mid-year report, and year-end report as outlined in the Policy and Procedures of PAR Tax Funding.

PAR Board Members |

|

|---|---|

| Term: April 2022-March 2024 | Term: April 2022-March 2026 |

| Jeremy Barker | Adam Provance |

| Kate Henderson | Cindy Sweat |

| Kimberly Stinson | Dean Duncan |

| Lee Taylor | Doug Holm |

| Patrice Bolen | Jim Brooks |

| Polly Dunn | Kurtt Boucher |

| Shane Lamb | Logan Millsap |

| Sydney Condie | Trevor Weight |

| Ximena Bishop | |